Just completed my refinance with RMCVanguard, at least I think the refinance is completed since I signed all the documents via a notary agent and that Bank of America sent me a “Mortgage Payoff Processed” email. Went through some hurdles, but ultimately completed it in the end.

Just completed my refinance with RMCVanguard, at least I think the refinance is completed since I signed all the documents via a notary agent and that Bank of America sent me a “Mortgage Payoff Processed” email. Went through some hurdles, but ultimately completed it in the end.

I had refinanced once in between from 6.625% to 5.125% (30 year fixed) with a different mortgage company I wouldn’t recommend. They were slow to respond to my emails and it took several calls to get through to them.

I’ve been monitoring the mortgage rates and my dad was trying to convince me to switch to a 15 year mortgage which was around 3.75% at that time. I did some calculation and 15 years at 3.75% would make my monthly personal spending extremely slim. I’ve gotten way too used to buying things whenever I want without having to worry about the price. Haha. It’s probably why people keep telling me it’s hard to figure out what present to get me. If I ever want anything, I would’ve purchased it already. ;p

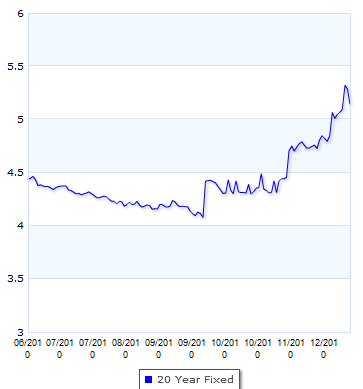

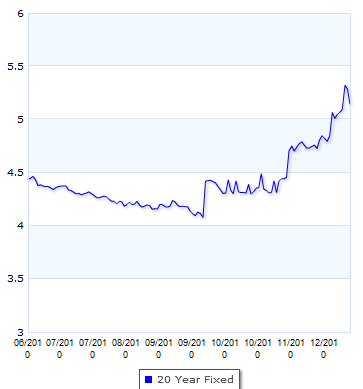

I spoke with Jesse about this awhile back and he said he was in a similar situation and was thinking of refinancing. 15 years made his monthly payment too high, but he was considering 20 years. Interesting thought and after I did my own calculations, 20 years would work out great for me too. So I began to monitor mortgage rates for 20 years.

I guess it was providence when RMCVanguard emailed asking if I was looking into refinancing. RMCVanguard was who I originally used when I first purchased my house. They were quick, easy, and professional. I asked him for rates for 20 year mortgage and he came back with 4.375%. I didn’t get a chance to reply until a few weeks later and told him I would want to wait till it hit 4.00% before refinancing. Within those few weeks, the mortgage rate apparently dropped to 4.00% and we got the ball rolling.

Most of the process was smooth, besides the appraisal. The guy who did my appraisal short changed me in square footage by almost 200sqft, and the appraised value put me at less than 5% ownership of the house. Because I owned less than 15% of the house, they could not give me the 4.00% rate, but was willing to give me a 4.125% instead. I objected to the appraisal and gave my previous 2 appraisals (one which was done previously by another appraiser sent by RMCVanguard). Apparently mortgage companies aren’t allowed to contact the appraisers directly, but instead have to go through some intermediary agent due to new mortgage legislation after the sub-prime mortgage meltdown.

After a couple times back and forth where I claim the appraisal is wrong and the appraiser claiming he made no mistake, the appraiser finally admitted he made a mistake, but wasn’t willing to change the appraised value. I’m like super pissed and sent off an email to the attorney general. Not sure if that had anything to do with it, but a few days later, I got another email from my mortgage broker informing me that the appraiser has submitted a new appraisal with an updated value. However it was still below 10%, so I still didn’t qualify for the 4.00% rate. At this time, I saw that mortgage rates had began to climb and decided to go with 4.125% and our refinance continue.

After that, things were pretty straight forward.

Side note, if you have a complaint regarding real estate services/agents, apparently you should submit them to DOL. Here’s the reply I got back from the Attorney General – Consumer Protection Division:

Our office has received your correspondence.

We have reviewed your complaint and determined that we are not the appropriate agency to assist you. We will retain a copy of your complaint in our public records. We have forwarded a copy of your complaint to:

Dept of Licensing – Real Estate Appraisers PO Box 9048 Olympia, WA 98507-9048 www.dol.wa.gov

(360) 902-3600

We recommend that you contact them directly if you have any additional information to add to your file.

Although we are unable to assist you with this matter, we appreciate you contacting our office.

4 years after first trying the Manhattan at Derek’s holiday party and creating my Facebook picture that lasted for years, I guess it was time to me to give it a try again given my new fondness for alcohol.

4 years after first trying the Manhattan at Derek’s holiday party and creating my Facebook picture that lasted for years, I guess it was time to me to give it a try again given my new fondness for alcohol.

Recently I’ve been hearing on the radio ads suggesting listeners to be unique/special and instead of giving a plain old boring gift this year, to donate in the name of the gift recipient. Personally I think it’s one of the worse presents ever. If you’re going to donate, donate because you want to. Don’t donate because you feel like you’re doing the recipient something special.

Recently I’ve been hearing on the radio ads suggesting listeners to be unique/special and instead of giving a plain old boring gift this year, to donate in the name of the gift recipient. Personally I think it’s one of the worse presents ever. If you’re going to donate, donate because you want to. Don’t donate because you feel like you’re doing the recipient something special.